[ad_1]

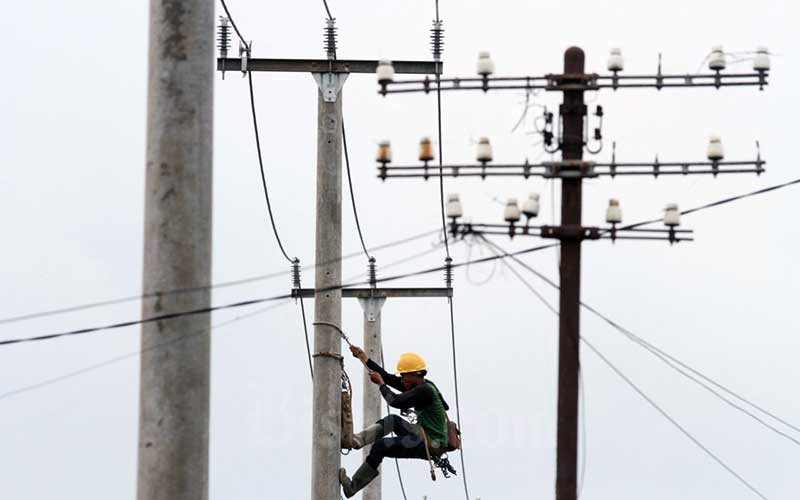

Lagos — Electricity Distribution Companies, DisCos, weekend, remained under pressure to meet the demand of customers under Band A, expected to enjoy a minimum of 20 hours of daily supply, as Nigeria’s power allocation dropped to 3,059MW, yesterday.

Data obtained from Energy System Operator, an autonomous unit in the Transmission of Nigeria, TCN, by Vanguard, indicated that the allocation was inadequate to meet the demand of Band A and other classes of consumers nationwide.

Checks by Vanguard showed that some DisCos were not able to meet targets as consumers classified under Band A complained of inadequate supply.

However, further checks showed that Abuja Disco (472MW), Ikeja Electric (465MW), and Eko DisCo (396MW) received the highest load allocation from the system operator.

Others were Ibadan DisCo (369MW); Benin DisCo (251MW); Enugu DisCo (221MW); Port Harcourt DisCo (218MW); Kano DisCo (207MW); Kaduna Electric (199MW); Jos DisCo (174MW); and Yola DisCo (87M).

On generation, data showed that 17 of the nation’s 26 power plants were on the grid as at 3pm, with Delta Plant (437MW), Azura IPP (414MW) and Egbin Power (381MW) were the top three suppliers to the national grid.

In an interview with Vanguard, the Executive Director, PowerUp Nigeria, Adetayo Adegbemle, said: “One of the major factors that determine these bands is the quality of infrastructure in these areas; another is the high volume of consumption of energy in these areas.

“One thing that is also common with these locations is that they are mostly affluent and high-income areas of society and they represent a disproportionately high share of energy consumed relative to their share of the customer population.

“We have major industries also covered. Many of the maximum demand users (industries and productive users of electricity) are covered under Band A feeders, thereby catalyzing industry as a vehicle for economic development.

“This increased energy supply to these feeders will reduce their net energy spend because otherwise, they would have to depend on diesel generating sets, which cost more than two times that of grid energy per kWh.”

On his part, Energy analyst and Expert, Prof. Wunmi Iledare, who supported the classification of customers into Bands, said: “There is a price discrimination application based on daily supply hours for selected users. Such a mechanism is not unusual in the power market.”

LPG price rises 7.10% in domestic market

Meanwhile, the price of the 5kg Liquefied Petroleum Gas, (Cooking gas) LPG, increased by 7.10 per cent on a month-on-month basis from N6,154.50 recorded in February 2024 to N6,591.62 in March 2024.

The National Bureau of Statistics, NBS, which made the disclosure, weekend, stated: “The average retail price for refilling a 5kg Cylinder of Liquefied Petroleum Gas (Cooking Gas) increased by 7.10% on a month-on-month basis from N6,154.50 recorded in February 2024 to N6,591.62 in March 2024.

“On a year-on-year basis, this increased by 42.97% from N4,610.48 in March 2023. On state profile analysis, Kano recorded the highest average price for refilling a 5kg Cylinder of Liquefied Petroleum Gas (Cooking Gas) with N7,609.00, followed by Ogun with N7,363.64, and Akwa Ibom with N7,162.50. On the other hand, Adamawa recorded the lowest price with N5,312.50, followed by Taraba and Zamfara with N5,375.00 and N5,550.00 respectively.

“In addition, analysis by zone showed that the South-South recorded the highest average retail price for refilling a 5kg Cylinder of Liquefied Petroleum Gas (Cooking Gas) with N7,003.08, followed by the South-West with N6,723.22 while the North-East recorded the lowest with N6,221.30.

“Also, the average retail price for refilling a 12.5kg Cylinder of Liquefied Petroleum Gas (Cooking Gas) increased by 5.77% on a month-on-month basis from N15,060.38 in February 2024 to N15,929.04 in March 2024.”

Kerosene price records marginal rise

Also, the NBS disclosed that “the average retail price per litre of Household Kerosene (HHK) paid by consumers in March 2024 was N1,354.40, showing an increase of 1.00% compared to N1,340.94 recorded in February 2024.

“On a year-on-year basis, the average retail price per litre of the product rose by 18.55% from N1,142.46 in March 2023. On state profile analysis, the highest average price per litre in March 2024 was recorded in Kaduna with N1,875.00, followed by Benue with N1,773.74 and Niger with N1,719.36.

“On the other hand, the lowest price was recorded in Rivers with N1,070.79, followed by Sokoto with N1,095.33 and Kwara with N1,110.90. In addition, analysis by zone showed that the North Central recorded the highest average retail price per litre of Household Kerosene with N1,497.13, followed by the North-East with N1,393.59, while the South-South recorded the lowest with N1,273.07.

Sign up for free AllAfrica Newsletters

Get the latest in African news delivered straight to your inbox

Success!

Almost finished…

We need to confirm your email address.

To complete the process, please follow the instructions in the email we just sent you.

Error!

There was a problem processing your submission. Please try again later.

“The average retail price per gallon of Household Kerosene paid by consumers in March 2024 was N4,899.33, indicating an increase of 0.40% from N4,880.02 in February 2024. On a year-on-year basis, this increased by 19.34% from N4,105.25 in March 2023.”

Why we reduced price of diesel — Dangote Refinery

However, in a statement obtained by Vanguard, the spokesperson of the Dangote Group, Mr. Anthony Chiejina, explained the recent slash in the price of diesel, adding that, “diesel imports for the high sulphur grade have been at significantly higher prices until we started operation. If indeed high sulphur diesel is sold at lower prices how come we never saw the lower prices until now?”

The group’s spokesperson affirmed that the real reason behind the Dangote diesel price reduction was principally due to the patriotism of the management to the nation as well as prevailing market dynamics of supply and demand.

“As the largest single-train refinery in the world, the Dangote refinery has a production capacity of 650,000 barrels per day, which is more than enough to meet the domestic demand of Nigeria and export to other countries’ economies.”

[ad_2]

Source link